Introduction To Tanla Platforms

Tanla Platforms Limited, earlier known as Tanla Solutions Ltd, is an Indian multinational cloud communications company based in Hyderabad. This company was established in the year 1999 by Desari Uday Kumar Reddy, who is currently the chairman and CEO of the company. The company provides value added services in the cloud communication space. It has more than 600 employees across its offices, including two of its overseas offices – Singapore and Dubai. Tanla platform got listed in the Indian Stock Market in December, 2006.

Tanla was started as a small group of mobile messaging experts, with base in Hyderabad. The company initially started as a bulk SMS provider in Hyderabad catering to SME. As the team grew, the company was evolved as the cloud communication provider with services and products with aggregators and Telcos across the globe.

Tanla platforms has recently acquired 100% stake in Value First Digital Media Pvt Ltd from US-Headquartered Twilio for $42 millions (Rs. 346 Crores). Value First is India’s 3rd larges CPaas player. CPaaS stands for Communication Platform as a Service. In the recently published Q3 result, Tanla Platform’s revenue increased by 15% YoY and the major portion of its growth came because of Value First. Value First will be the game changer for the Tanla’s business in the future.

Market Position

Tanla Platforms is the largest player in Indian CPaaS industry with a revenue market share of about 42%. The company launched Wisely and Trubloq in 2021 and acquired 100% stake in Value First recently. So the growth journey of the company has just begun. Trubloq is world’s first blockchain enabled CPaaS stack and Wisely is the patented digital market place for enterprise and mobile carrier created in partnership with Microsoft. Wisely platform has been granted 3 patents in cryptography and blockchain processed by United States Patents and Trademark Office.

It is not that easy to get patents. If a company has been granted patents, then it shows its money and research that have been spend on its R&D. As per Gartner report, the global CPaaS industry is expected to grow at 30% CAGR up to 2025. And hence Tanle being the biggest player in the industry, this growth would definitely benefit its business.

Financial Performance

The revenue increased from Rs. 178 Crores in March-2012 to Rs. 3756 Crores in the year. That’s an exceptional 21x growth in revenue in the last 12 years. If we talk about the net profit, there was a loss of Rs. 157 Crores in Mar-2012 while in TTM there is a profit of 538. Operating profit margin is well maintained about 19%-20% for a long time. The current OMP% is 19%. The recent ROE and ROCE of the company are 31.2% and 37.9% respectively which are pretty good.

Cash from operating activity stood at Rs. 247 Crores. Cash from operating activity is one of the most important aspect for the company as this amount can be used for the future of the company or for repayment of debt. The latest Q3FY24 result is here.

Business Strategy

From 2000 until now, it has come in an extended manner. Today, they’ll be proud to have carried out global control in their region as virtually taken into consideration one of the maximum critical cloud communication carriers withinside the world. There are nearly 8 billion humans on this planet so can all of them purchase a single enterprise’s product, definitely not, each enterprise will become aware of the institution of audiences who’re truly interested in shopping their enterprise product they may be known as goal audiences.

To discover the audience, we must discover the identifiers that differentiate them from the others however how are we able to become aware of them? For this, we must use a segmentation process. The segmentation manner divides the huge audiences into small groups. As preferred, we can use democratic segmentation, geographic segmentation, psychographic segmentation, behavioral segmentation and geodemographic segmentation.

But Tanla has used geodemographic segmentation and psychographic segmentation which segregate the clients via way of means of age, gender, income, own circle of relatives, repute, equation and region, country, state, metro city, urban city, rural city, habits & personality. To become aware of the target audiences, Tanla systems make use of specific promoting techniques in social media video campaigns. Rather than analyzing blogs and vlogs for the long term simply with one click on looking at a video on social media creates flexibility for the clients thru social analysis, video promotion, backed posts, and social posting for all systems like campaigns, live-tweeting etc.

Risk Factors

Being the biggest player in the industry, Tanla has some potential risks also which can hamper its businesses. Some of the major risks are discussed here:

Competitive Risk of Tanla Platforms

The enterprise business is majorly dominated by two major players in India: Route Mobile and Tanla Platforms. The recent player in this industry is now Bharti Airtel with this business as Airtel iQ. Earlier Tanla used to be major player in this industry. Although it is still the biggest player in this field. But because of the increasing competitions, its business can be affected negatively. Enterprise business commands a gross margin of 19%-20% and EBIT margin of 11%, so there definitely will be margin pressure.

However the key segment for Tanla’s future growth is its digital platform business. Within this Tanla has Trubloq and Wisely. Trubloq checks the SMS content against pre-registered content template and rejects messages if templates are violated and also enforced DND (Do Not Disturb). So essentially it not allows SMS transmission if a certain enterprise account has been blocked via DND by a customer, i.e., filtering spam messages.

Wisely is the updated version of Trubloq with an additional features that can ensure better delivery, tracking leakage prevention of communication via SMS/WhatsApp for enterprise while allowing third party suppliers such as core AI to provide plugin play CPaaS services such as ChatBot which enterprises can leverage for a one-stop solution.

Valuation

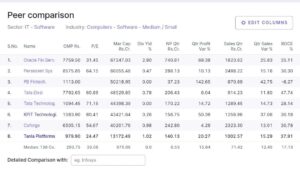

The company’s current PE ratio is 24.5 and the median PE for the last 5 years is 29.8. It means from the PE ratio’s perspective, the company looks undervalued. The current PB ratio is 7.54 and the median PB ratio for the last 5 years is 7.4. Hence on the basis of PB ratio, company looks fairly valued. Also on the basis of market cap/sales, the company looks fairly valued. On comparing the company’s metrics with its peers, Tanla looks attractive.

Conclusion

The share price of the company has barely moved compared to its share price 3 years ago, while its revenue increased from Rs. 2341 Cr. to current TTM Rs. 3756 Crs. and also its net profit increased from Rs. 356 Cr to latest TTM Rs. 677 Cr. Hence, on improving the global situation and market sentiments, the share price will move very fast from the current level. Promoter are consistently increasing their stakes as 41.22% in March 2021 to 44.16% in Dec-2023. Also the weak hands, retail investors, are losing the shares in the same period from 43.69% to 39.46%. This shows the confidence of the promoters in the company.

Hence, on looking upon all the financial ratios , comparing with its competitors and the future of the company, the current valuation of the company seems attractive. The company can generate multi-bagger returns from the current share price also just as it has created multi-bagger returns in the past.

Related Blogs: