Introduction To Affle India

Affle (India) Limited was incorporated as a private limited company with the name Tejus Securities Private Limited on August 18, 1994. In January 2006, the Company was owned and managed by Mukesh Tulsyan, Raj Pal Singh Rana and certain other shareholders. Later in January 2006, the entire equity share capital of Tejus Securities Private Limited was acquired by Anuj Khanna Sohum, individual Promoter, along with Anuj Kumar and Madhusudan Ramakrishna. Thereafter, the name of the Company was changed to Affle (India) Private Limited in September, 2006. The Company was subsequently got listed in the Indian Stock Exchanges and the name of the Company was changed to its present name, i.e., Affle (India) Limited in July, 2018.

Affle India is a global digital marketing company with proprietary consumer intelligence platform that delivers consumer acquisitions, engagements and transactions through relevant mobile advertising. Basically, this company helps global brands enhance their returns on marketing investment through contextual mobile ads and also by reducing digital ad fraud. contextual ad means the ads are placed as per the content of the page. For example, if you visit money control, you would see ads of companies like brokerage houses or a mutual fund house promoting their mutual fund. In addition to this, you would also see ads of companies whose page or website you visited recently.

Company has evolved their algorithms over the period of last 15 years with strong research and development. Affle India uses artificial intelligence, machine learning and deep learning algorithms to generate consumer insights for better targeted marketing.

Business Model

As discussed earlier, Affle is in the business of digital marketing where it uses its own propriety algorithm that churns consumer data and generate insights for relevant digital marketing for its clients. It predicts user interests and maintains engagement through continuous data updates. Affle collaborates with eCommerce Companies to deliver relevant mobile ads and facilitates transactions.

Affle India has a very unique business model. Unlike other players who charge advertisers for click & impressions, Affle revenue is based on driving conversions. It earns its revenue on a Cost Per Converted User (CPCU) basis. It means it charges from the advertisers only if the customer clicks on the ad, goes to apps store, downloads the app and launches in the mobile phones.

CPCU business model of the Affle India contributes around 92.9% of the total revenues of the company. The remaining 7.1% revenue comes from Non-CPCU businesses like enterprise platforms where Affle enables offline business to go online through mobile apps development, building e-commerce website and apps and also provide data analytics services to generate better insights. Geographically, India contributes around 31.1% and remaining 68.9% is from international markets with focus on emerging markets like Africa, Latin America, Vietnam, Thailand, etc.

Future Growth Prospects

The future of digital marketing is definitely very bright. Although there is already a strong adoption of digital marketing in developed markets like USA, Canada, Europe, etc., the emerging markets have more scope than developed markets for the digital marketing agencies like Affle India as there is still huge scope in digital markets. As per research global digital market can grow with a CAGR of 9% and emerging markets like India are expected to grow at 25-30 percent CAGR.

The majority population of India are between 18 to 30 and these people prefer to use smart phones to communicate. And since more and more consumer are preferring to use smartphones to interact with, digital platforms across your e-Commerce, OTT, Fintech, Online gaming, healthcare, telecom, education, etc. are driving the need for advertisers to reach consumers on smartphones and adopt omnichannel marketing strategy. Hence every company is exploring the digital marketing channels to promote their products and services and this trend would continue to grow in the future.

The industry of digital advertising increased from Rs. 47 billions in FY15 to Rs. 160 billions in FY19 and expected to reach Rs. 539 billions till the end of FY24, i.e., the CAGR of 27%. The business of Affle India are currently affected because of the global recession and slowdown in the developed markets as the company’s around 68% business comes from the global markets. This is the reason the share price of the company is in consolidation phase since 3 years. But the future of the company is definitely very bright.

Key Strength And Risk

The Affle India has around 2.8 billion consumer profiles which help in predictive optimization algorithm. This is the core of the business which helps the company in right target marketing. Also the company has recently filed for 15 patents and the company already has 21 grants across USA, India and Singapore. The patents are the most important thing for a tech company as it creates a moat (competitive advantage) for the company.

The asset light model of the company is also one of the key strengths of the company. The best part of the company’s business model is that it is a technology based asset light company and hence expenses are minimal. Due to which the scalability potential of the company is immense. Another key strength of the company is its own business model, i.e., CPCU. The CPCU is already mentioned above. In the CPCU business, the advertisers are mostly benefited because they have to pay only when the user is actually converted to the customer and this model makes the company grow its business for longer run.

If we look at the potential risks about the business of the Affle, it collects a lot of data of the consumers. If there is a new regulation around the consumer protection that restricts Affle India to collect data from various sources, it can adversely affect its business. One more risk is technological risk, i.e., if the company failed to predict an engagement by consumer with mobile ads with sufficient degree of accuracy it could have a negative impact in its business. The another risk is for the company is a huge competitive field the company operates. Its competitors are the giants like Google and Meta and these company’s potential is not hidden for anyone.

Leadership

Mr. Anuj Khanna Sohum is the founder, MD and CEO of the company. He has the working experience in the business of technology for over 20 year. He has completed a bachelor’s degree in computer engineering from the National University of Singapore (NUS) on a full scholarship. He has also completed the Stanford Executive Program from Stanford University and the Owner/President Management Program from Harvard Business School.

Mr. Anuj Khanna says that “We are not of the DNA that says let’s get investors money and get growth. We are not wired like that. Business is about profit and being cash flow positive.” This is the reason that Affle India is profitable since day 1. So the management wise of the company the future looks very bright of Affle India.

Financials

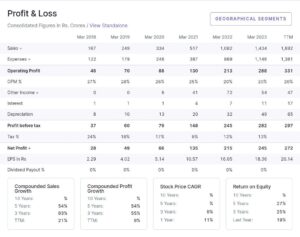

The latest quarterly result can be seen here

As we can see from the screenshot given above, the revenue increased from 167 Crores in 2018 to 1692 Crores in the TTM. This means the revenues grew to more than 10x in the last 6 years. The profit of the company grew from 9.7x from March 2018 to December 2023 from 28 Cr to 272 Crs. The margins of the company is currently 19% which low compared to its historical profit margin. The ROE and ROCE of the company are 18.5% and 20.0% respectively. These numbers are pretty good.

From a long-term perspective, we believe Affle India has strong device and client additions. We also believe that the company has superior penetration in the International business and strong revenue growth potential going ahead. Currently the company commands a PE ratio of 57.6 but the historical median PE is 66.5. So on the basis of the PE ratio the company looks undervalued. Although the company might not deliver a good returns quickly in a few months or years but it will definitely come on track after the global markets get out of the recession and slowdown.

The company’s share price has not increased since February 2021. Though the reasons are obvious that the company could not grow at its usual speed like it used to grow from 2018 to 2021. When the markets will ease, the financials of the company is definitely going to improve and so share price of the company will follow. So considering the future prospects of the company, it can be considered as a SIP grade stock. Each fall can be utilized for the accumulation.

These are all my personal analysis. Please do not invest any stock based on someone else’s view. Do your own research before investing your money in the equity market.

The other company discussed earlier: IDFC First Bank