Introduction Of The IDFC First Bank

IDFC First Bank is an Indian private sector bank formed by the merger of the banking arm of Infrastructure Development Finance Company (IDFC) and Capital First on 18th December, 2018. Mr. V. Vaidyanathan is the MD and CEO of IDFC First Bank since the merger in 2018. Prior to assuming this role, he held the position of Chief Executive Officer at ICICI Prudential Life Insurance and was a member of the board of the governors at ICICI Bank. It is the first universal bank to offer monthly interest credit on saving accounts, lifetime free credit cards with dynamic and low annual percentage rates.

IDFC Limited was set up in 1997 to finance infrastructure projects in India by the Government of India. It also diversified its businesses in the field of asset management, institutional broking and investment banking. Its shares got listed on stock exchanges in 2005. In January 2018, IDFC Ltd and non-banking financial company Capital First announced a merger.

Capital First, then called Future Capital Holdings, was an Indian non-bank Financial Institution providing debt financing to small entrepreneurs, MSMEs (Micro, Small and Medium Enterprises) and Indian consumers. It went public on India’s stock exchanges in 2008. Capital First was founded in 2012 by V. Vaidyanathan who acquired a stake in Future Capital Holdings and secured equity backing of Rs. 8.10 billion from Warburg Pincus.

Financial Performance of IDFC First Bank

Company’s Total income stood at Rs. 9,395.95 Crores which is 32.9% up on YoY basis while 6.9% up on QoQ basis. Its Net Profit stood at Rs. 715 Crore which 18.3% up YoY basis but it’s 4.7% down on QoQ basis. Capital Adequacy Ratio is 16.73% which was 16.54% last year for the same period. Gross and Net NPAs are 2.04% and 0.68% respectively and both are improved in both on YoY and QoQ basis and also it is one of the best in the industry. The only concern about its latest quarterly result is the Provision.

Provision is the reason its net profit fell on QoQ basis. Otherwise, all the parameters of the company were really good. To watch the complete Q3FY24 result of the company click here. Although, the company declared a decent result, the share price still fell 7-8 percentage on the very next day of declaring its Q3FY24 result. The main concern of the market was probably the increased provisioning of the bank.

The company is one of the fastest growing private bank in the Indian private bank industry. It has already overachieved its 2018 growth guidance in almost all the parameters. Hence, it can be considered a good company on the basis of the financial growth.

Business Model

IDFC First has been very aggressive in the retail segment, i.e., giving loans to the general public instead of big corporates as the chances of bad loans are very low in the case of retail loans. The bank aims to be predominantly a retail bank. Although It has not entirely shifted its focus from corporate banking, it has trade, forex, cash management, salary accounts, treasury, and related businesses.

The main focus of the bank is to use Capital First’s tried and tested model of financing small entrepreneurs and consumers on a bank platform (which is IDFC bank). With IDFC’s strong branch network and rural presence, the company aims to use the advantages offered by both these companies and use them to expand in the retail segment.

The company’s share of corporate funded was 90% in March-2018 which is currently 37%. While its retail business was only 10% in 2018 while it is 63% as of today. By seeing this trend, It’s clearly understood that the company is really focused towards making the business of the bank majorly relied on the retail business instead of corporate business. The bank also offers Working Capital Loans and Corporate Loans for Business Banking and Corporate Customers in India. But majorly, it focuses on the retail segment.

Key Financial Ratios

Financial Ratios are the most important things of the company the investors should have in mind. If you want to have the basic knowledge of the financial ratios, read my blog on 7 Financial Ratios for Stock Analysis. Here the most important ratios of the bank is discussed and the screenshot of the screener is put here:

The PE ratio of IDFC First Bank as of 29.02.2024 is 18.94 while its median PE for the past 5 years is 21.5. PB ratio currently is just 2.05 while its median PB ratio is 1.4. So if we compare PE ratio with its historical median PE the company looks undervalued while if we do so with PB ratio it looks overvalued at current price.

CASA ratio for IDFC First stands at 46.8% and has seen a consistent increase over the years which is a good sign for the bank as it decreases the cost of funds. IDFC first is focusing on becoming a Retail focused bank, due to which we can see a further high increase in CASA ratio for the bank. (CASA (Current & Saving Account) ratio is a very cheap source of funds for a bank as these deposits carry comparatively lower interest rates. Thus, the higher the ratio, the better it is for the bank).

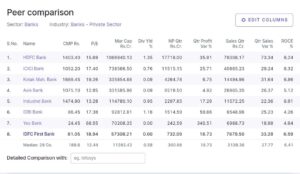

IDFC First Bank has a average ROA (Return on Asset) track record. The ROA of IDFC First Bank is at 1.16 %. ROA denotes how profitable a company is in comparison with its total assets. Its Return on Equity (ROE) is 10.67% and Return on Capital Employed (ROCE) is 6.59%. Net Interest Margin (NIM) was 6.42% in Q3FY24 as compared to 6.13% in Q2FY24. Capital Adequacy Ratio is 16.73% which was 16.54% last year for the same period. In the given screenshot we can compare the ratios of the IDFC First Bank with its peers.

Growth Prospects

Once retail & Corporate loan book ratio reaches 70:30 its loan book will begin zooming &, looking at speed of increasing CASA from 26% to 47%, this target is not vey far. Branches are growing fast to offer more exposure to bank. The number of its branches in 2018 was just 206 while it’s currently 897 across the country. It has began reducing interest margins (7% is now offered to FDs to the limit of 1 Cr only) so margins will improve fast. By seeing its fantastic growth since this bank’s existence and on the basis of its Growth Guidance 2.O, it can easily achieve all its target till FY29.

The main person behind the success story of the IDFC First Bank is none other than Mr. V. Vaidyanathan. He is the same person who transitioned to ICICI to lead their retail lending operations as they expanded beyond project lending. His responsibilities involved setting up the businesses, including all key functions related to strategy, team building, business relationships, credit policy, credit administration and risk management. So keeping the faith in him and watching his past records as a banker and also the works done in IDFC First Bank till date, he can really make this company a really big bank.

Risk and Challenges

In the recent declared quarterly result of Q3FY24, the company has increased its provision to 45% which is a big concern and for the same reason market took it negatively and the shar price of the IDFC First Bank tanked from the high of 100 to 80.55 as of 28.02.2024. Provision for any bank refers to as the amount that are set aside from the bank’s profit, to cover the potential losses arising from the bad loans and non-performing assets (NPAs). The provision might be the reason for degrowth of the profit of the company in Q3FY24.

Although this concern is definitely for a short term, longer picture of any company is decided on the basis of its fundamentals. And the fundamentals of the IDFC First Bank is decent. Hence the current fall in the share price can be utilized as an opportunity to accumulate the shares. If everything goes as planned, it can definitely become the multibagger stock of its investors.

Recent Developments

Recently the company has given its growth guidance for the next 5 years, i.e., FY29. According to the growth guidance given the expect the number of the bank’s branches to 1700-1800 which is today is 897. CASA deposit is expected to be Rs. 2,85,000 Cr which is currently Rs. 85,492 Cr. Customer deposit and term deposits are currently 176,481 Cr and 90,990 Cr and these are expected to reach 585,000 Cr and 300,000 Cr respectively.

The company expects its loans and advances to grow to Rs. 5,00,000 Cr which is currently 1,89,475 Cr. And total asset to grow to 7,00,000 Cr vs currently 2,70,738 Cr. The company expects its Gross NPA and Net NPA up to 1.5% and 0.4% respectively Vs the currently 2.04% and 0.68%. We can see the confidence of the CEO of the company in the interview given by him after the Q3FY24 result.

As the company’s growth guidance given in 2018, the company achieved its targets in almost all of the goals. Someone said it rightly “Don’t invest in a bank, invest in a banker”. The banker of the IDFC First Bank is Mr. V. Vaidyanathan. He has a proven track record. The work he has done in ICICI bank to transform it from a wholesale funded bank to a retail funded bank. Also if it could outperformed its growth guidance of 2018, it can also outperform its growth guidance of 2024 for FY29.

If we look at the share price of the stock, in last 1 year there was a sharp outperformance of the share from the low of about 50 to as high as 100 but it’s been nearly 5 months since the share price has corrected about 20%. If we look at the valuation, PE(18.9) and PB(2.06), which in my opinion the stock looks really attractive at the current level. The 20% fall in the share price can be utilized as the opportunity to accumulate the shares for the future as it can easily be doubled, tripled and more from the current level.

But at the end of the day, you need to decide whether you are a believer in the bank’s future prospects or not. It all depends upon the execution, and for that you need a strong leadership and I have a strong faith in Mr. V Vaidyanathan. He is a veteran having an experience of more than 3 decades in the banking industry.

This analysis is just for educational purpose. Please do your own research before investing your own money in any company.

1 thought on “Is IDFC First Bank Share Good To Buy?”